We are partnering with you in pursuit of a Smart Energy Future influenced by customers. We commit to ensuring continued reliability through a balanced and flexible energy mix and helping to create a cleaner environment driven by increased renewables and significant carbon reductions, all while responsibly managing costs.

Our IRP, submitted every three years to the IURC, demonstrates how the company plans to generate and deliver safe, reliable and reasonably priced electricity to its southwestern Indiana customers through a forecast spanning 20 years.

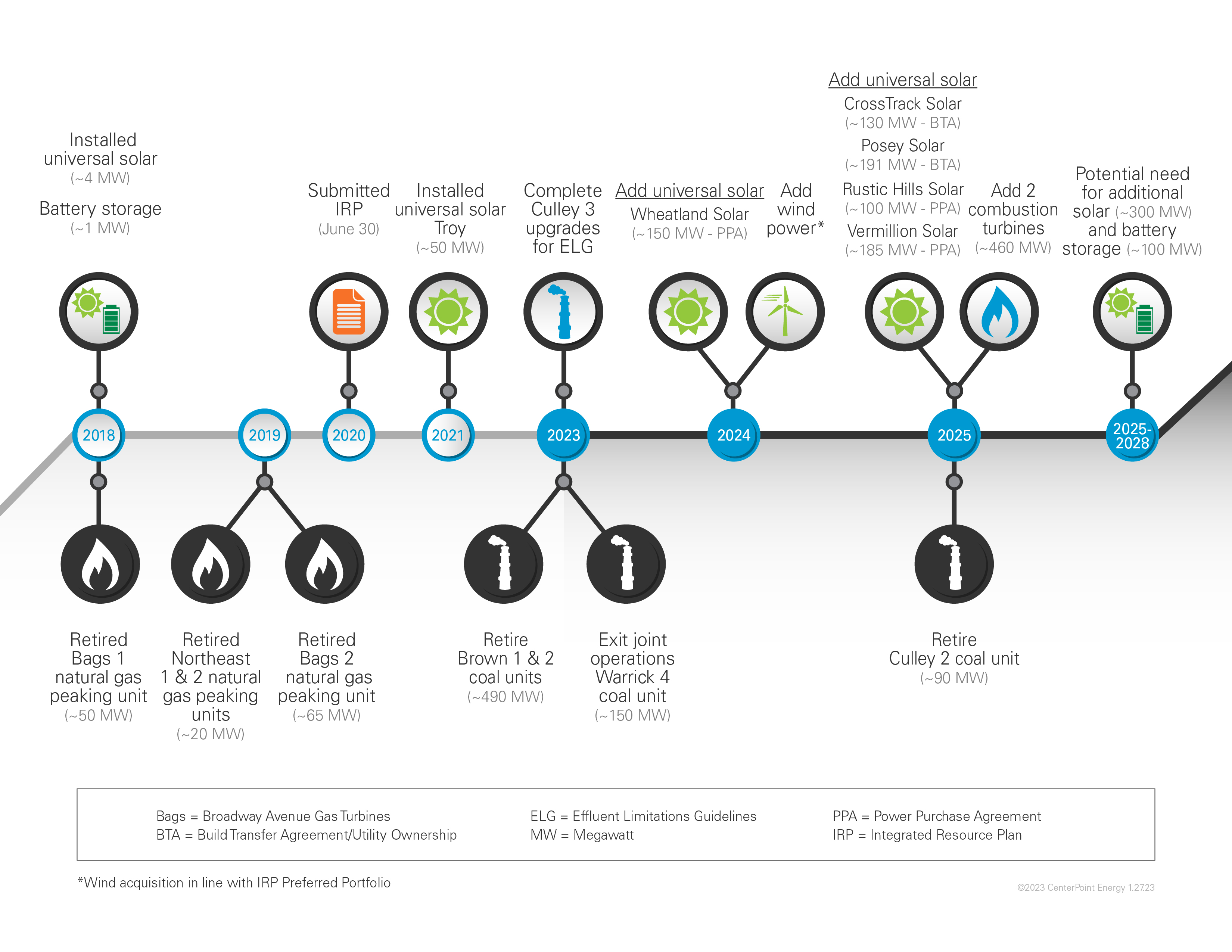

During our final Integrated Resource Plan (IRP) public stakeholder meeting, we presented a preferred portfolio to diversify its electric generation fleet in the coming years.

The plan could save customers more than $320 million over the 20-year planning period and lower carbon emissions by nearly 75% from 2005 levels by replacing some older coal generation units with significant renewables, including a large percentage of universal solar.

This plan, which considered public stakeholder input, the outcomes of an All-Source RFP, and a wide variety of economic variables is the second consecutive IRP to point the utility in the direction of future resource diversity. Modeling conducted within the analysis points us to:

- Retiring or exiting agreements involving 730 megawatts (MW) of traditional generation, thereby avoiding investments estimated at $700 million to comply with strict environmental regulations

- Adding 700-1,000 MW of solar (some connected to battery energy storage) and 300 MW of wind renewable resources, which would allow all our electric customers access to solar-powered energy at significantly lower costs than customer-owned generation; and reduce carbon emissions by nearly 75%. Learn more

- Adding 460 MW of natural gas combustion turbines; approximately half the natural gas capacity of the combined cycle gas turbine proposed in the previous IRP and designed to back up the renewable resources supplying the majority of our customers’ energy needs

Programs and services are operated under the brand CenterPoint Energy by Southern Indiana Gas and Electric Company d/b/a CenterPoint Energy Indiana South.